South Korea has one of the world’s most dynamic economies, yet managing personal finances can be challenging due to high living costs and complex financial systems. Whether you are a resident or an expat, understanding how to budget, save, and invest effectively is essential for financial stability. InfoNow Korea (인포나우코리아) provides valuable insights into navigating South Korea’s financial landscape.

Understanding the Cost of Living in South Korea

Seoul and other major cities can be expensive, especially when it comes to rent, transportation, and dining out. Rent for a one-bedroom apartment in Seoul can range from 500,000 to 1,500,000 KRW per month, depending on the location and type of lease agreement. Jeonse, a lump-sum deposit rental system, is common and requires a substantial upfront payment but reduces monthly rent costs.

Seoul and other major cities can be expensive, especially when it comes to rent, transportation, and dining out. Rent for a one-bedroom apartment in Seoul can range from 500,000 to 1,500,000 KRW per month, depending on the location and type of lease agreement. Jeonse, a lump-sum deposit rental system, is common and requires a substantial upfront payment but reduces monthly rent costs.

Public transportation is affordable, with a subway ride costing around 1,250 KRW. Many residents prefer using rechargeable T-money cards to save on fares. Private car ownership is costly due to fuel prices, taxes, and mandatory insurance. Opting for public transport or car-sharing services can significantly reduce commuting expenses.

Creating a Realistic Budget

A well-planned budget helps you control spending and save effectively. Use the 50/30/20 rule: allocate 50% of your income to necessities like rent and utilities, 30% to discretionary expenses such as entertainment and dining, and 20% to savings and investments. South Korea has multiple budgeting apps like Toss and Banksalad that help track expenses in real time and provide financial insights.

Cutting Unnecessary Expenses

Dining out is popular in South Korea, but cooking at home can save a significant amount of money. Grocery delivery services like Market Kurly offer affordable alternatives to eating out. Shopping during discount periods or using points and cashback programs from credit cards can also help reduce expenses.

Subscription services, such as streaming platforms or gym memberships, can add up quickly. Review your monthly subscriptions and cancel those you rarely use.

Saving Money Wisely

Building an emergency fund is crucial. Aim to save at least three to six months’ worth of living expenses. Major banks like KB Kookmin, Woori, and Shinhan offer high-interest savings accounts with competitive rates.

Using Government Savings Programs

South Korea offers special savings accounts for foreign workers and residents, such as the ISA (Individual Savings Account), which provides tax benefits. There are also pension savings plans like the National Pension Scheme (NPS), which ensures long-term financial security for both Koreans and expatriates.

For students and young professionals, some banks offer tailored savings programs with higher interest rates and additional benefits.

Investing for the Future

Investing is key to growing wealth. The Korean stock market (KOSPI) provides opportunities for investors, and real estate remains a strong asset class. Mutual funds and ETFs are also popular among beginners who want diversified investments with lower risks.

Understanding Cryptocurrency Investments

South Korea is a global hub for cryptocurrency trading. While investing in digital assets can be profitable, it also comes with risks. Always research before investing in platforms like Upbit or Bithumb. The government has imposed regulations to protect investors, so staying updated on policies is essential.

Traditional investments, such as fixed deposits or government bonds, can provide stability for those who prefer lower-risk options.

Managing Debt Effectively

Credit card use is widespread, but interest rates can be high. Paying off outstanding balances monthly helps avoid debt accumulation. If needed, consider refinancing loans through government-backed programs or switching to low-interest personal loans offered by banks.

Student loans and personal loans should also be managed wisely. The government offers repayment assistance programs for students who struggle with loan payments.

READ ALSO: The Vital Basics Of Money Management

Protecting Your Finances

Insurance is an essential part of financial planning. Health insurance is mandatory in South Korea, and expats can enroll in the National Health Insurance (NHI) system. Additionally, having life and accident insurance can provide financial security for you and your family.

Scams and financial fraud are concerns in South Korea. Be cautious when sharing financial information and avoid investment schemes that promise unrealistic returns.

Conclusion

Managing personal finances in South Korea requires careful planning, smart budgeting, and informed investment decisions. By understanding living costs, utilizing budgeting tools, saving wisely, and making smart investment choices, financial stability is within reach. Take advantage of available resources and government programs to build a secure financial future.

Finance plays a major role in how outdoor spaces are designed. Homeowners and developers now look beyond visual appeal. They want outdoor areas that add real value. Every design choice is often reviewed with cost and long-term use in mind.

Finance plays a major role in how outdoor spaces are designed. Homeowners and developers now look beyond visual appeal. They want outdoor areas that add real value. Every design choice is often reviewed with cost and long-term use in mind.

Seoul and other major cities can be expensive, especially when it comes to rent, transportation, and dining out. Rent for a one-bedroom apartment in Seoul can range from 500,000 to 1,500,000 KRW per month, depending on the location and type of lease agreement. Jeonse, a lump-sum deposit rental system, is common and requires a substantial upfront payment but reduces monthly rent costs.

Seoul and other major cities can be expensive, especially when it comes to rent, transportation, and dining out. Rent for a one-bedroom apartment in Seoul can range from 500,000 to 1,500,000 KRW per month, depending on the location and type of lease agreement. Jeonse, a lump-sum deposit rental system, is common and requires a substantial upfront payment but reduces monthly rent costs.

Fighting over money as a married couple is never a picnic. Seeking advice from financial advisers or accountants would be a big help, especially if you are already headed down a rough road. A solid financial strategy and budget can be developed through their collaborative effort.

Fighting over money as a married couple is never a picnic. Seeking advice from financial advisers or accountants would be a big help, especially if you are already headed down a rough road. A solid financial strategy and budget can be developed through their collaborative effort.

Since many consumers now use mobile phone apps as ewallets, entrepreneurs who want to keep payment methods simple ask if having a bank account is still relevant? The answer of course is yes, maintaining a bank deposit account is still relevant and in certain cases a business requirement.

Since many consumers now use mobile phone apps as ewallets, entrepreneurs who want to keep payment methods simple ask if having a bank account is still relevant? The answer of course is yes, maintaining a bank deposit account is still relevant and in certain cases a business requirement. A business organization registered as a Limited Liability Company (LLC) or as a corporation is required to maintain a bank account. A business bank account serves as a means of maintaining control over the funds derived from business operations and over payments of business expenditures and obligations.

A business organization registered as a Limited Liability Company (LLC) or as a corporation is required to maintain a bank account. A business bank account serves as a means of maintaining control over the funds derived from business operations and over payments of business expenditures and obligations. An entrepreneur will find it easier to organize and manage finances because banks provide a breakdown of transactions related to the movement of funds held in a bank account. Actually it simplifies the bookkeeping process, especially for taxation purposes.

An entrepreneur will find it easier to organize and manage finances because banks provide a breakdown of transactions related to the movement of funds held in a bank account. Actually it simplifies the bookkeeping process, especially for taxation purposes. For a business’s or company’s marketing plan and efforts to be effective and successful, adaptation to what works now is essential. For different marketing avenues like traditional media (TV, radio, print publications) and digital media (email, social media, website), what might have been very effective years ago may not be practical, worthwhile or relevant today.

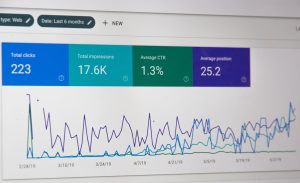

For a business’s or company’s marketing plan and efforts to be effective and successful, adaptation to what works now is essential. For different marketing avenues like traditional media (TV, radio, print publications) and digital media (email, social media, website), what might have been very effective years ago may not be practical, worthwhile or relevant today. Search Engine Optimization For Financial Services

Search Engine Optimization For Financial Services Fortunately, there are financing companies that offer financing solutions for such purposes.

Fortunately, there are financing companies that offer financing solutions for such purposes. Typically, the requested funding will be used to pay a Vendor or Supplier who is in the business of wholesale trading or manufacturing. In some cases, a merchant needs financing to pay a technology or marketing service provider.

Typically, the requested funding will be used to pay a Vendor or Supplier who is in the business of wholesale trading or manufacturing. In some cases, a merchant needs financing to pay a technology or marketing service provider. A successful ecommerce website is mobile-friendly in the sense that online shoppers can browse, shop and pay for purchases straight form their smartphone or tablet with practically zero hassle. Recent studies show that this is the most important aspect as about 61% of online shoppers prefer using their mobile device when shopping online. A mobile-friendly store means everything displayed on the screen of their mobile device can be viewed in the appropriate screen size.

A successful ecommerce website is mobile-friendly in the sense that online shoppers can browse, shop and pay for purchases straight form their smartphone or tablet with practically zero hassle. Recent studies show that this is the most important aspect as about 61% of online shoppers prefer using their mobile device when shopping online. A mobile-friendly store means everything displayed on the screen of their mobile device can be viewed in the appropriate screen size.